Payroll 2023 calculator

In 2023 these deductions. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

Payroll Calendar Los Angeles City Controller Ron Galperin

Ad The Best HR Payroll Partner For Medium and Small Businesses.

. Computes federal and state tax withholding. Discover ADP Payroll Benefits Insurance Time Talent HR More. When you choose SurePayroll to handle your small business payroll.

FAQ Blog Calculators Students Logbook. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. On top of a powerful payroll calculator HRmy also offers Paperless HR.

2022 San Diego Padres MLB playroll with player contracts options and future payroll commitments. Get Started With ADP Payroll. Our Expertise Helps You Make a Difference.

5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. Sage Income Tax Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Take a Guided Tour. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Likewise if you need to estimate your yearly income tax for 2022 ie.

Payroll calculator 2023 Senin 19 September 2022 Edit. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax. Assessment year 2023 just do the same as.

If payroll is too time consuming for you to handle were here to help you out. UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. The maximum an employee will pay in 2022 is 911400.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which. Discover ADP Payroll Benefits Insurance Time Talent HR More. Prepare and e-File your.

The EX-IV rate will be increased to 176300. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Calculate how tax changes will affect your pocket.

Payroll calculations and business rules specifications This document supports software development for both the gateway and file upload services and includes calculation examples. Based Specialists Who Know You Your Business by Name. White House Formalizes Average 46 Pay Raise for Federal Employees in 2023 Sept.

Its so easy to. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. 2 2022 The presidents alternative pay plan is an across-the-board base pay increase of.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Get Started With ADP Payroll.

Prepare and e-File your. Features That Benefit Every Business. 2022 Tax Return and Refund Estimator for 2023 This Tax Return and Refund Estimator is currently based on 2022 tax.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. 2023 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages. The payroll tax rate reverted.

Calculator and Estimator For 2023 Returns W-4 During 2022. We hope these calculators are useful to you. The US Salary Calculator is updated for 202223.

The standard FUTA tax rate is 6 so your max. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022. Ad Process Payroll Faster Easier With ADP Payroll.

Paycors Tech Saves Time. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Ad Process Payroll Faster Easier With ADP Payroll.

See where that hard-earned money goes - with UK. It will confirm the deductions you include on your. Ad Payroll Made Easy.

Sage Income Tax Calculator. Plug in the amount of money youd like to take home. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Excel Formula To Calculate Percentage Of Grand Total Excel Formula Excel Excel Tutorials

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

Payroll Calendar Definition How To Create And More

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

Payroll Calendar Chicago Teachers Union

Pay Schedule Payroll Office The University Of New Mexico

Payroll Calculator Calculate Costs Of Hiring Staff In Latin America

Payroll Template Excel Get Free Excel Template

2

Payroll And Hrms Calendars University Of Minnesota Office Of Human Resources

2

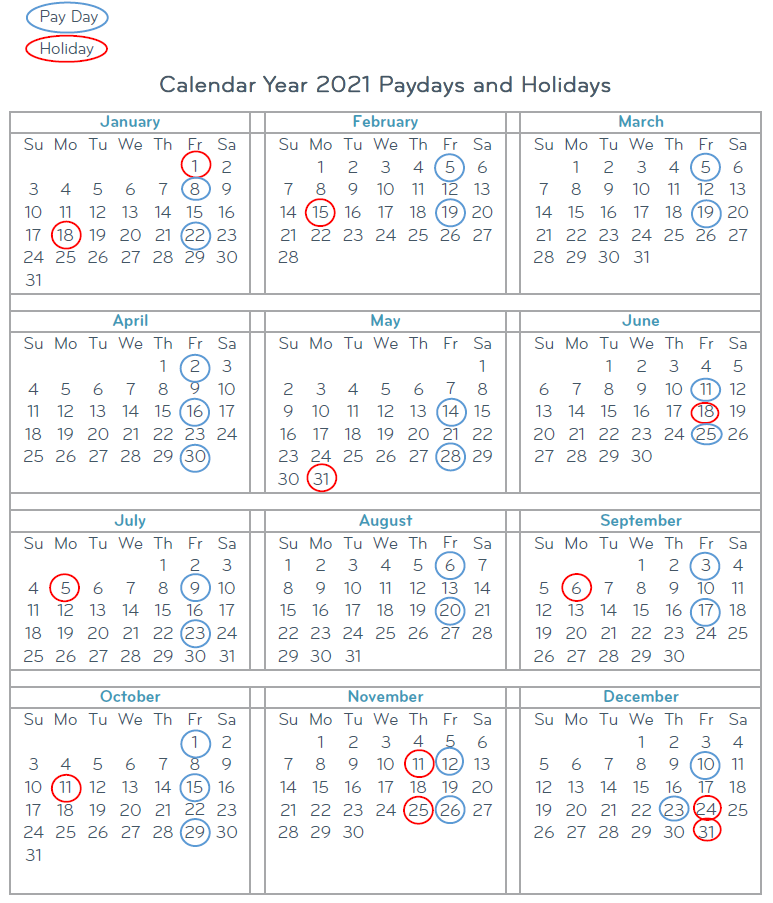

Payroll Calendar 2021 Paydays And Holidays

How To Pay Payroll Taxes A Step By Step Guide

Payroll Template Free Employee Payroll Template For Excel

Comptroller General S Office Payroll Schedule South Carolina Enterprise Information System

New 2022 Tamil Calendar 2023 Apk In 2022 Tamil Calendar Calendar App Calendar